When someone uses a taxpayer’s personal information to open credit cards, obtain mortgages, buy a car, or open other accounts without their knowledge, not involving tax filings.įor the third type of identity theft, non-tax identity theft, there is no need to report the theft to the IRS. The taxpayer tries to file a return, but the attempt is rejected because someone has already filed using the taxpayer’s or a dependent’s social security number. The IRS identifies a suspicious attempt to file a return and notifies the taxpayer that it will not process the return until the taxpayer responds. The IRS has identified three types of identity theft: The instructions differ depending on whether the IRS identifies the possible identity theft or the taxpayer identifies the identity theft.

#IP PIN IRS HOW TO#

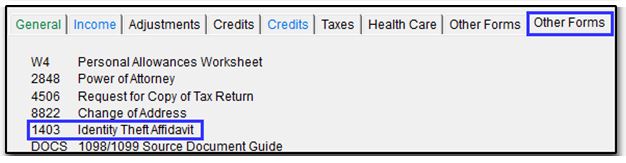

Now, the IRS has released revised, clear instructions on what to do in different scenarios and on how to protect yourself from tax identity theft in advance. Many taxpayers also wonder if they need to get an identity theft PIN even if they have not had a problem. In the past, it has been confusing for taxpayers to figure out what to do when their returns are rejected or when the IRS notifies them that someone attempted to file their return.

Tax-related identity theft is a continuing problem, although the IRS and taxpayers have gotten much better at combating it in the last few years. Technology Governance & Optimization Back.Environmental, Social and Governance Back.Research & Development Tax Credits Back.Employee Retention Tax Credit (ERTC) Back.

0 kommentar(er)

0 kommentar(er)